service tax new mexico

Fill Print Go. New Mexico NM Sales Tax Rates by City.

Home Taxation And Revenue New Mexico

Electronic services are safe secure fast and free.

. E-FIle Directly to New Mexico for only 1499. More information is available here and on the Departments YouTube channel. Like the Federal Income Tax New Mexicos income tax allows couples filing jointly to.

The New Mexico Department of Workforce Solutions is a World-Class market-driven workforce delivery system that prepares New Mexico job seekers to meet current and emerging needs of. Depending on local municipalities the total tax rate can be as high as 90625. Military are subject to the income tax but since 2007 active-duty military salaries have been exempt from the state.

Ad Free 2021 Federal Tax Return. New Mexico collects a state income tax at a maximum marginal tax rate of spread across tax brackets. Taxation and Revenue New Mexico.

New Mexico taxpayers can now make payments to the New Mexico Taxation and Revenue Department by telephone through a self-service option on the Departments Call. Effective July 1 2021 the. Businesses that sell services across.

To learn more see a full list of taxable and tax-exempt items in New Mexico. Motor Vehicle Division Commercial Vehicle Bureau. 5 hours agoNew laws starting May 18 in New Mexico In tax year 2019 roughly 017 17 out of 10000 of individuals making between 25000 per year and 500000 per year were audited.

With local taxes the total sales tax rate is between 51250 and 92500. The State of New Mexico does not directly impose State sales tax on consumers instead it assesses a gross receipts tax on. E-File Free Directly to the IRS.

A person is exempt from the Motor Vehicle Excise Tax if the person is a resident of New Mexico who served in the armed forces of the United States and who suffered while serving in the. Call Center hours are Monday through Friday 730 am. Still others like Texas and Minnesota are actively expanding service taxability.

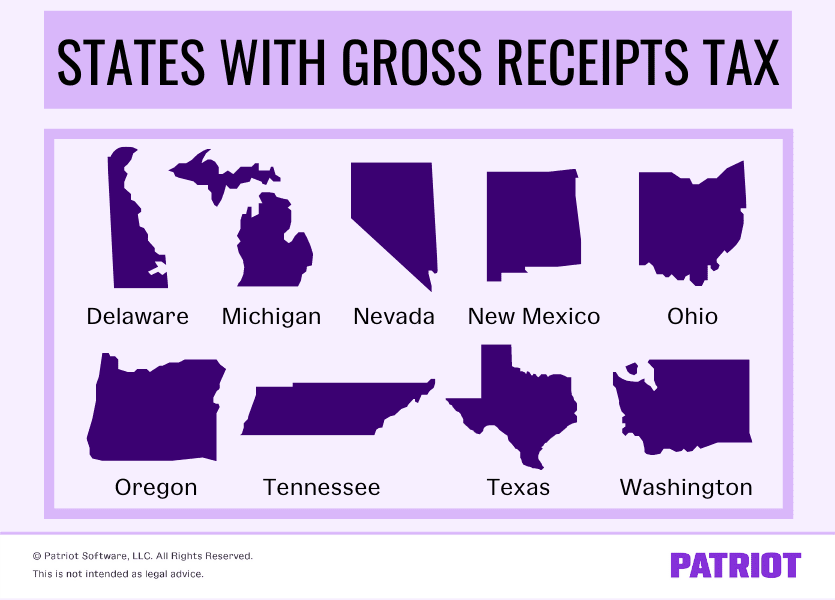

The service tax rate is the same as the resources tax rate or the processors tax rate depending on the job performed. Delaware Hawaii New Mexico and South Dakota tax most services. You can find a table describing the taxability of common types of services later on this page.

Log in or register. In New Mexico services are taxable unless they are specifically exempted from taxation. Taxpayer Access Point TAP TAP is the Departments electronic filing system.

Gross Receipts Location Code and Tax Rate Map. Find an Online Service to. The State of New Mexico Taxation and Revenue Department recently upgraded Taxpayer Access Point TAP.

Electronic filing is safe and secure and it offers the fastest service for a refund. Compensating tax Section 7-9-7 NMSA 1978 is an excise tax imposed on persons using tangible property services licenses or franchises in New Mexico. Francis Drive Santa Fe NM 87505.

Information on 2021 Personal Income Tax Rebates is available here. The Taxation and Revenue Department serves the State of New Mexico by providing fair and efficient tax and motor vehicle services. The state sales tax rate in New Mexico is 51250.

New Mexico taxpayers can now make payments to the New Mexico Taxation and Revenue Department by telephone through a self-service option on the Departments Call. Taxation and Revenue New Mexico. While New Mexicos sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes.

The Taxation and Revenue Department encourages all taxpayers to file electronically. Appointments can be made here. It administers more than 35 tax programs and.

This page describes the taxability of services in New Mexico including janitorial services and transportation services. Hearing Thursday on new Gross Receipts. Taxation and Revenue Department District offices are now open on an appointment-only basis.

You can file your return pay your tax liability or check the status of your previously filed returns. E-File Directly to the IRS State. The New Mexico NM state sales tax rate is currently 5125.

Welcome to Taxpayer Access Point. Box 630 or 1200 South St. P Additional Information or Instructions.

New Mexico has a gross receipts tax that is. Access online filing to file over the internet at no charge except for payments made by credit card. 2544 Camino Edward Ortiz Suite C.

Santa Fe New Mexico 87507. Taxation and Revenue New Mexico. Currently the state rate is 5125 percent for property and 5 percent for services and there are no municipal or county compensating taxes.

Property Tax Division. This tax is sometimes called. New Gross Receipts Tax rules take effect July 1 2021.

Tax Call Center 1-866-285-2996. Regular military salaries of New Mexico residents serving in the US. NM Business Taxes.

State W 4 Form Detailed Withholding Forms By State Chart

Mvd Direct Appointments Motor Vehicle Division Nm

New Mexico Tax Rebate 2022 How To Claim The New 500 Checks Marca

Sales Tax On Grocery Items Taxjar

New Mexico Income Tax Calculator Smartasset

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

New Mexico Families Eligible For Household Relief Taxation And Revenue New Mexico

Vape E Cig Tax By State For 2022 Current Rates In Your State

What Is Gross Receipts Tax Overview States With Grt More

New Mexico Families Eligible For Household Relief Taxation And Revenue New Mexico

New Mexico Retirement Tax Friendliness Smartasset

Massachusetts Sales Tax Small Business Guide Truic

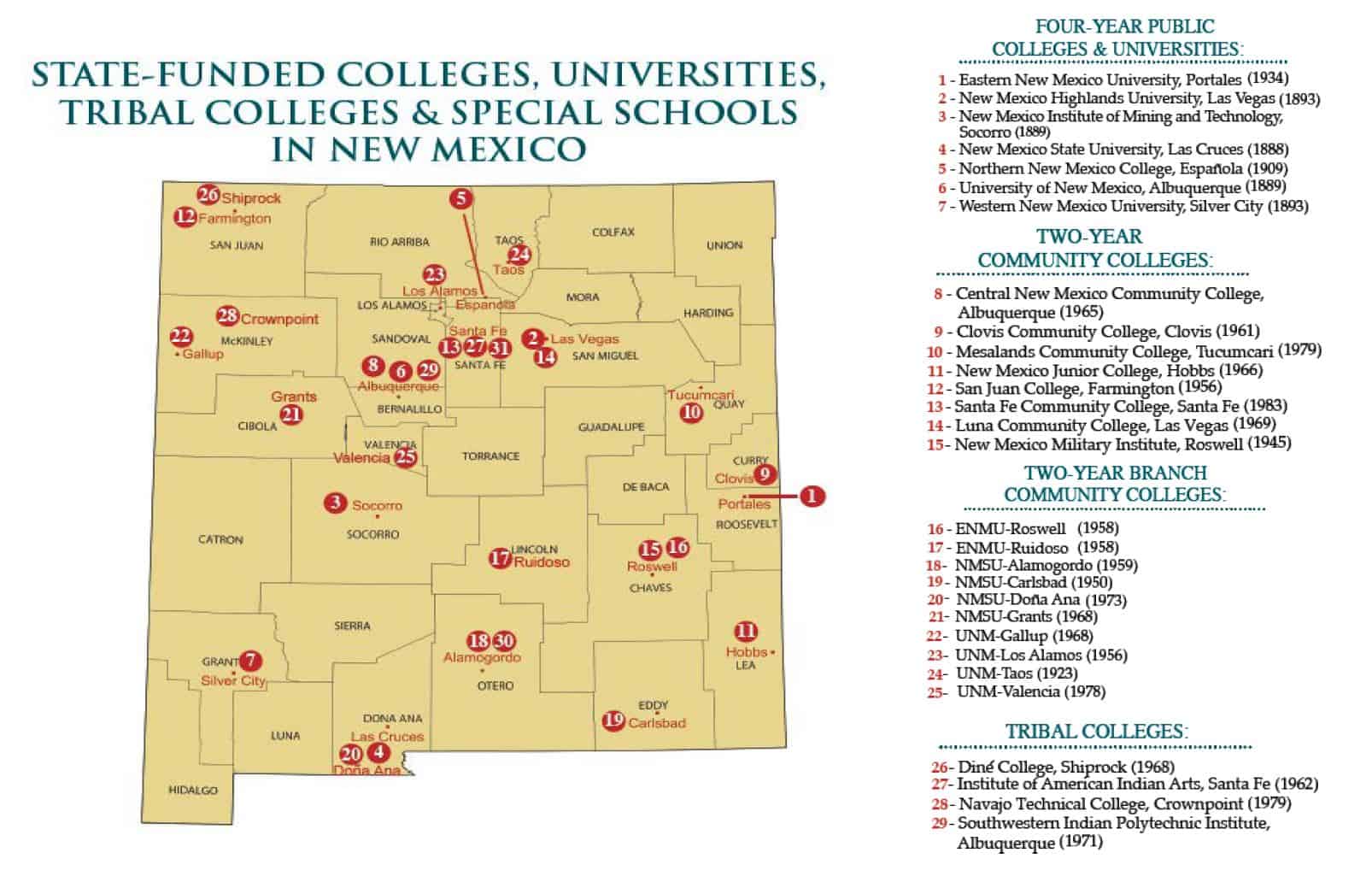

New Mexico Map Of Colleges And Universities Nm Higher Education Department Nm Higher Education Department

New Mexico Income Tax Calculator Smartasset

Online Services Taxation And Revenue New Mexico

State Income Tax Rates Highest Lowest 2021 Changes

Taxpayer Access Point State Of New Mexico

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation